Roth IRA vs. Roth 401(k)

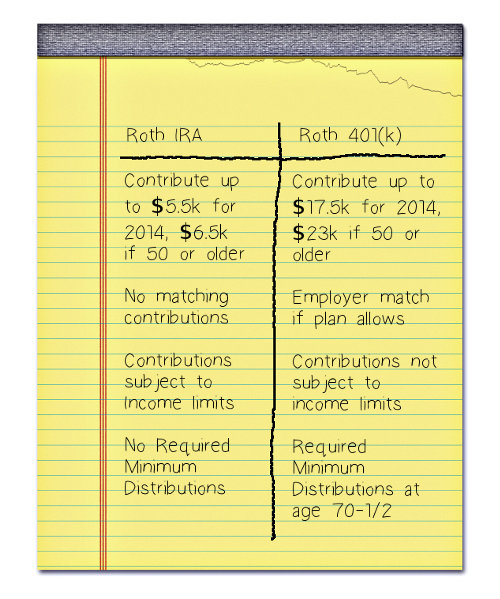

First, the contribution limits are significantly larger -- in 2014, you can contribute up to $17,500 ($23,000 if over 50) per year to your Roth 401(k), while your contributions to a regular Roth IRA are limited to $5,500 ($6,500 if over 50). You cannot contribute to a Roth IRA at all if your income exceeds the IRS limits, while these income limits do not apply to a Roth 401(k).

However, there is one disadvantage to the Roth 401(k) that you should be aware of. Unlike a Roth IRA, a Roth 401(k) is subject to the employer plan rule that Required Minimum Distributions (RMDs) must be taken starting at age 70-1/2. If you were counting on not having to take an RMD from this asset, then you will need to roll your Roth 401(k) assets into a Roth IRA before the year in which you turn 70-1/2.

Like a 401(k) plan, you do not have to take an RMD if you are still employed and contributing to the Roth 401(k) after age 70-1/2. Once you leave that employment, the RMD rules will kick in. If this sounds confusing, be sure to contact one of our financial advisors.

Stout Bowman regularly posts important and interesting information on our blog. Current topics include credit/debit/loans, estate planning, insurance, investing, Medicare, retirement, Social Security and taxes, as well as general information that we think you might find of interest.

Stout Bowman regularly posts important and interesting information on our blog. Current topics include credit/debit/loans, estate planning, insurance, investing, Medicare, retirement, Social Security and taxes, as well as general information that we think you might find of interest.  We have been publishing an email newsletter for our clients and friends since 2016. Links to all of the newsletters can be found on our newsletter page, with the most recent listed first. We try to keep our emails short, so there are typically only three articles in each one, most of which link to other articles in the financial and mainstream press.

We have been publishing an email newsletter for our clients and friends since 2016. Links to all of the newsletters can be found on our newsletter page, with the most recent listed first. We try to keep our emails short, so there are typically only three articles in each one, most of which link to other articles in the financial and mainstream press.  We also have a page on our site for the latest news about our company, notice of any upcoming events, and a market commentary to discuss what our advisors and other financial industry experts conclude about the previous investment performance and what we might expect the markets and the economy will do in the coming months.

We also have a page on our site for the latest news about our company, notice of any upcoming events, and a market commentary to discuss what our advisors and other financial industry experts conclude about the previous investment performance and what we might expect the markets and the economy will do in the coming months.  Many news organizations offer what is called a Rich Site Summary (RSS) feed, a listing of the latest changes to their site's content. We have subscribed to several of these news feeds and present a list of their latest ten articles on a page on this website to save our clients the hassle of going to multiple websites just to see what is available. Currently, we subscribe to

Many news organizations offer what is called a Rich Site Summary (RSS) feed, a listing of the latest changes to their site's content. We have subscribed to several of these news feeds and present a list of their latest ten articles on a page on this website to save our clients the hassle of going to multiple websites just to see what is available. Currently, we subscribe to  At Stout Bowman every investment client is first a financial planning client; it's important to go through that process before we make any professional investment recommendations. Therefore, we strive to make financial planning understandable and comfortable every step of the way. One way to do that is to provide our clients access to financial education resources. To that end, we have subscribed to educational websites to receive their news feeds and present a list of their latest ten articles on a page on this website. Currently, we offer

At Stout Bowman every investment client is first a financial planning client; it's important to go through that process before we make any professional investment recommendations. Therefore, we strive to make financial planning understandable and comfortable every step of the way. One way to do that is to provide our clients access to financial education resources. To that end, we have subscribed to educational websites to receive their news feeds and present a list of their latest ten articles on a page on this website. Currently, we offer